Every independent insurance agent knows the moment. A longtime client calls to add their teenager to the family auto policy. You run the numbers. The premium jumps 80-136%. You deliver the news, brace for the pushback, and hope they don't start shopping.

But here's what most agents miss: the premium increase isn't the real threat. The real threat comes six months later, when that teenager has their first at-fault accident—and you're suddenly fighting to keep a client relationship you've built over years.

Teen driver safety isn't just a family concern. For insurance agents, it's a retention strategy. And there's a research-backed approach that most agents have never heard of.

The Numbers That Should Keep You Up at Night

Let's start with what the data actually shows about teen drivers on your book.

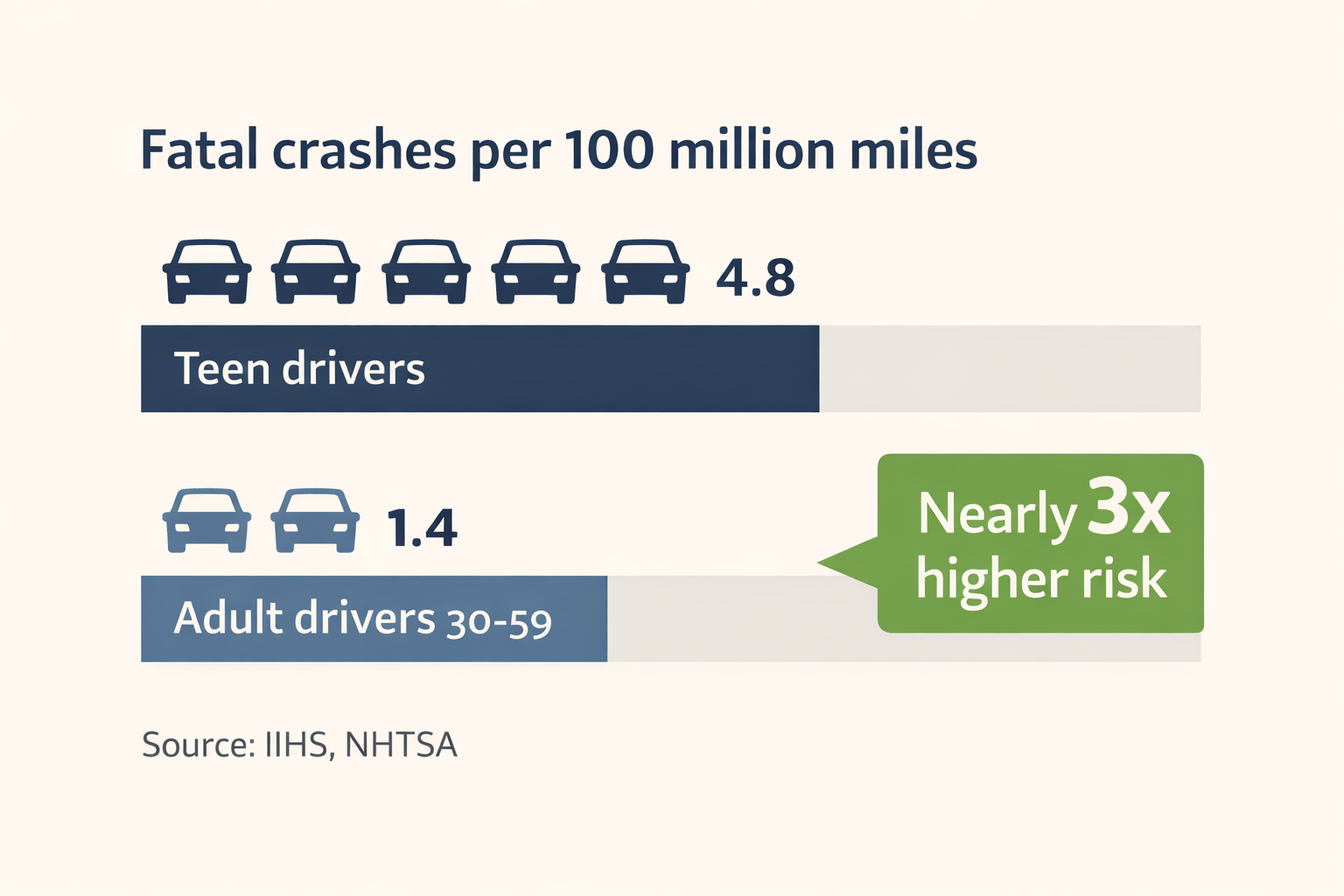

Teen drivers ages 16-19 have a fatal crash rate nearly three times higher than drivers 20 and older per mile driven. According to NHTSA, they're involved in 4.8 fatal crashes per 100 million miles traveled—compared to just 1.4 for drivers ages 30-59.

But it gets worse in the first months of independent driving. NIH research found that teens are eight times more likely to crash in the first three months after getting their license compared to the three months before, when they were still on a learner's permit with a parent in the car.

The causes aren't mysterious. AAA Foundation research using dash cam footage found that decision errors—failing to yield, running stop signs, excessive speed—were involved in 66% of teen crashes. Distraction or inattention appeared in 58%.

And peer passengers make everything worse. A teen driver's death risk increases 44% with just one passenger under 21. With three or more teen passengers, the risk quadruples.

These aren't just statistics. They're the crashes waiting to happen on your book of business.

What Teen Crashes Actually Cost Your Agency

Here's where this becomes a business problem, not just a safety concern.

The insurance industry is experiencing record churn. According to LexisNexis, over 45% of policies in force were shopped at least once by the end of 2024—the highest level ever recorded. Retention has dropped to 78%, down five points since 2021. That translates to roughly six million more policies switching carriers annually compared to three years ago.

Now layer in what happens after a claim. J.D. Power research shows that 52% of customers who rate their claims experience as "poor" will leave or not renew. Even satisfied claimants aren't guaranteed to stay.

And what about the economics of losing that client?

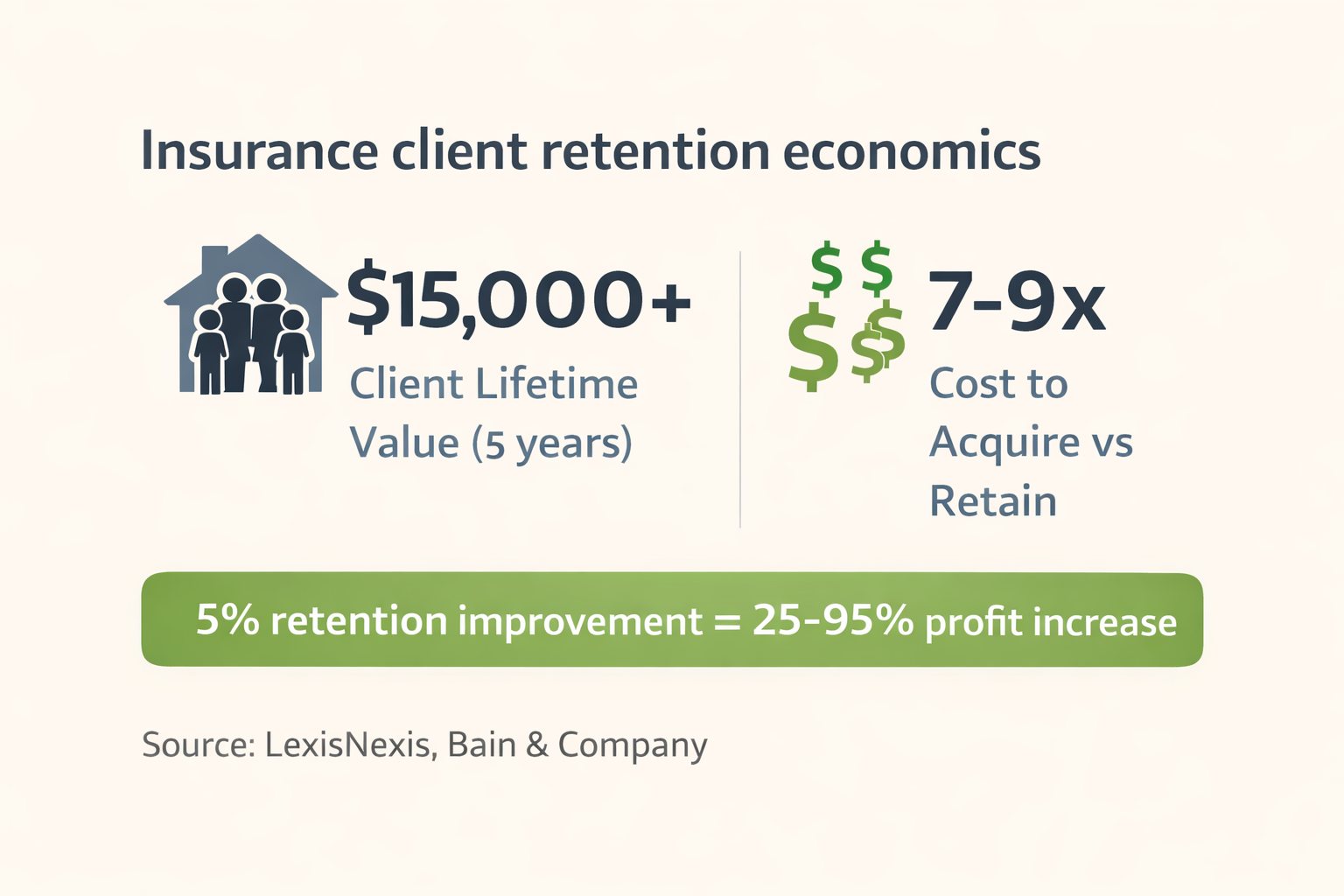

Insurance has the highest customer acquisition costs of any industry. It costs 7-9 times more to acquire a new customer than to retain an existing one. Acquisition typically consumes 75-100% of first-year revenue—meaning you barely break even until year two.

The math is brutal: a family paying $3,000 annually represents $15,000+ in lifetime value to your agency. When their teen has an at-fault accident and they leave after a rate increase, that's $15,000 walking out the door—plus $20,000+ to acquire a replacement.

This is why a 5% improvement in retention can increase profits by 25-95%. And preventing teen crashes is one of the highest-leverage retention strategies available.

The Research That Changes Everything

Here's what most people—including most insurance agents—don't know: there's strong scientific evidence that the quality of parent-supervised practice dramatically affects teen crash rates. Not just the quantity of hours. The quality.

An NIH study published in JAMA Pediatrics found that youth with regular, more frequent practice sessions had a 39% lower crash risk in their first year of independent driving. Even more surprising: teens who made more errors during supervised practice had 54% lower crash risk afterward. Errors during supervision, it turns out, create learning opportunities. Errors during solo driving create claims.

International research confirms this pattern. Swedish teens who practiced 120 hours had 46% fewer crashes than those who practiced 50 hours. Australian teens completing 100 hours of quality practice had dramatically better outcomes—boys showed 87% fewer traffic offenses, and girls showed zero self-reported crashes compared to 6.6% for the control group.

The most compelling evidence comes from Children's Hospital of Philadelphia. Their TeenDrivingPlan study found that teens whose families followed a structured parent coaching program were 65% less likely to make dangerous driving errors during on-road assessment. Only 6% of program users had their assessment terminated for unsafe driving, compared to 15% of non-users.

Sixty-five percent fewer dangerous errors. That's not a marginal improvement. That's a different risk category entirely.

The Gap Nobody Is Filling

So if quality parent coaching works this well, why aren't insurers providing it?

They're not. Here's what carriers currently offer for teen driver safety:

Good student discounts (5-35%): Rewards academic performance, which has minimal correlation with driving skill.

Driver's education discounts (5-15%): Rewards course completion. But driver's ed provides only about six hours of behind-the-wheel training. The other 50+ hours required by most states? That's on parents.

Telematics programs (up to 30-40%): Monitors driving behavior after the teen is already licensed. Useful for catching problems, but doesn't prevent them.

Notice what's missing? Nothing teaches parents how to use those 50+ hours of required supervised practice effectively.

This isn't speculation. NIH researchers have explicitly documented this gap: "While many companies currently offer information about the dangers of teen driving... no systematic evaluations of these initiatives have been conducted." And more pointedly: "Parent management of novice teen driving has rarely been studied systematically. There remain huge gaps in what is known about how parents teach their teenage children to drive."

Most parent-supervised practice is, frankly, low quality—"primarily consisting of drives of convenience consistent with the family's routine." Trips to school. Runs to the grocery store. The same routes, the same conditions, over and over.

Meanwhile, only 32% of parents even know the correct number of supervised hours required in their state.

This is the gap. Parents are responsible for 95% of their teen's driving practice, but nobody teaches them how to do it well. The research proves quality coaching works. The infrastructure to deliver it doesn't exist.

Until now.

The Opportunity You're Missing

Adding a teen driver creates the single best cross-sell opportunity of the client relationship. Think about it: the family is already thinking about risk, already thinking about coverage, already having a conversation with you.

Consider umbrella policies. Teen drivers increase umbrella premiums by 100-300%—which reflects genuine increased exposure. Teens have three times the fatal crash rate of adults. Thirteen percent of personal injury awards exceed $1 million. And yet only about 20% of American households have umbrella coverage.

The teen driver conversation is the natural moment to discuss umbrella protection. And here's the retention kicker: multi-policy holders have a 95% retention rate compared to the industry average of around 84%. Cross-selling reduces churn by up to 50%.

But the real opportunity isn't just selling more policies. It's positioning yourself differently.

The agent who calls to say "your premium is going up $2,000" is a policy vendor.

The agent who calls to say "your premium is going up, but I want to talk about how we can keep your family safe and protect your assets" is a trusted advisor.

One of those agents keeps the client. The other watches them shop.

A Resource That Serves Everyone's Interests

"The Parent's Roadmap to Safe Teen Driving" is an online course that teaches parents how to effectively coach their teenager through supervised driving practice. It's built on the neuroscience of adolescent brain development and the research showing that quality practice—not just logged hours—determines crash risk.

The course covers what parents actually need: how the teenage brain processes risk differently, how to structure progressive practice sessions, how to stay calm when your teen makes mistakes, and how to know when they're actually ready for more challenging driving situations.

For agents, this creates a compelling value-add. You're not just recommending a product—you're giving clients a resource backed by research from NIH, CHOP, and AAA Foundation showing 39-65% reductions in dangerous driving errors and crash risk.

When you recommend this course, you're doing three things simultaneously:

Protecting your book. Fewer crashes means fewer claims. Fewer claims means fewer rate increases. Fewer rate increases means lower churn.

Adding genuine value. This isn't a gimmick. The research is real. Parents who follow structured coaching programs produce safer teen drivers.

Differentiating yourself. Most agents have no idea this research exists. You'll be the agent who actually helps families stay safe, not just the one who collects premiums.

The Affiliate Opportunity

We're building an affiliate program for independent insurance agents. Here's how it works:

For your clients: The course normally costs $129. With your referral code, they pay $100—a meaningful discount that makes you look good for offering it.

For you: You earn $20 for every enrollment. Not a fortune, but it adds up—and the real value is in the retention and relationship benefits.

For the community: $20 from every sale goes to charity. When your clients ask about it, you can honestly say this is about safety, not sales.

The economics work because our interests align. You want clients who don't file claims. We want parents who raise safe drivers. Both happen when families get quality coaching.

Think about the math: if you have 50 families with teen drivers on your book, and even half of them take the course, that's 25 enrollments at $20 each—$500 in direct commission. But the real return is the claims that don't happen, the renewals that don't churn, and the referrals from clients who remember you as the agent who actually helped.

The Bottom Line

Teen drivers crash at four times the adult rate. In the current retention environment—45% shopping rates, 78% retention, six million more policies churning annually—every teen on your book is a retention risk waiting to activate.

The research is clear: quality parent coaching reduces crash risk by 39-65%. But nobody's providing it at scale.

You can be the agent who just processes the teen driver addition and hopes for the best. Or you can be the agent who gives families a genuine resource, protects your book, and positions yourself as a trusted advisor rather than a policy vendor.

The first type of agent wonders why retention is getting harder. The second type wonders what took everyone else so long to figure this out.

Interested in becoming an affiliate?

We're looking for independent agents who understand that protecting clients and protecting your book aren't competing goals—they're the same goal.

Learn About the Affiliate Program